arizona charitable tax credit fund

Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. Step 3 - Receive your tax credit celebrate.

The Arizona Charitable Tax Credit is a dollar-for-dollar tax credit that reduces the taxpayers tax liability what is owed for AZ state taxes.

. While many other worthwhile nonprofits also qualify for. By investing in United Ways Arizona Charitable Tax Credit you put families on the. Tax credits either reduce what you owe to the state or increase your refund dollar-for-dollar.

Maximum credit for the 2021 tax return. Max refund is guaranteed and 100 accurate. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

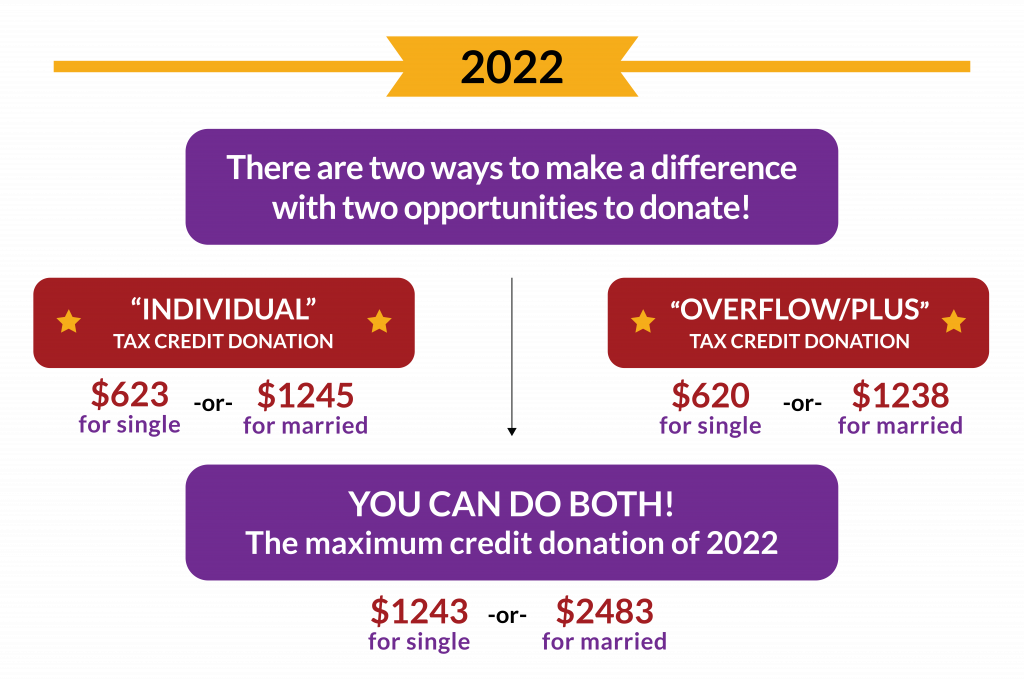

Make a gift to the YMCA Tax Credit Fund. 400 for single heads of household and married filing separate filers. Contributions for the 2022 tax year can be made through April 15th 2023.

A tax credit is a better deal and this is how Arizonas charitable tax credit policy works. Uses Tax Credit Form 321. If you earned 40000 a tax credit policy means that with a 3 tax rate you would owe 1200 in taxes.

The Arizona Charitable Tax Credit permits any credits for contributions to Qualified Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs that are not applied against tax obligations for the most recent taxable year to be carried forward for a period of five consecutive years. In Arizona you choose where your money goes. New Look At Your Financial Strategy.

DONATIONS FOR TAX YEAR 2021 MAY BE MADE THROUGH APRIL 15 2022. Complete Edit or Print Tax Forms Instantly. This video describes how the Charitable Tax credit works.

Starting in 2016 the tax credit is 800 for married taxpayers and 400 for single taxpayers or. You can direct your state tax dollars to support the work of local charities. The Arizona Charitable Tax Credit allows you to give up to 400 per individual or 800 per couple filing jointly each year to a Qualifying Charitable Organization QCO and receive a dollar-for-dollar tax credit on your state tax obligation.

Tax credits are more valuable than a tax deduction. Qualifying Charitable Organizations QCO Credit. Ad All Major Tax Situations Are Supported for Free.

Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans. Arizona law allows you to claim a tax credit of up to 1000 for joint filers and up to 500 for individual filers for voluntary contributions you make during any taxable year. A portion of the state tax dollars they owe or already paid to an organization that provides help to the working poor - all at no financial cost to themselves.

Start Your Tax Return Today. Ad Access Tax Forms. The YMCA Tax Credit Fund LLC qualifies as a QCO.

You can give hope to families and individuals by making a contribution. For the Arizona Foster Care Tax Credit that amount is 1000 for married couples filing jointly and 500 for individual taxpayers and married couples filing separately. By leveraging the Arizona Charitable Tax Credit you take control of where your tax dollars go.

Maximum contributions are 400 for filing single or 800 for filing jointly. Your donation will either reduce the total Arizona state income tax you owe or increase the state income tax refund you receive dollar-for-dollar when you file your taxes up to 800 if youre married and file jointly or up to 400 if you file as an individual. Your donation to the QCO tax credit will support organizations assisting low-income children individuals and families.

Arizona Charitable Tax Benefits. YOURE AT THE RIGHT PLACE. Credit can offset Arizona tax liability dollar for dollar but is not refundable.

AFFCF is a qualifying Foster Care Charitable Organization. But since you donated 400 to Flagstaff Shelter Services and 500 to a foster care organization you can subtract that from the 1200 tax bill so you only owe 300 in taxes. If you choose to take advantage of the Charitable Tax Credit through Mesa United Way you may still also take the full amount on.

Give a charitable donation that assists hardworking families by supporting areas like job skill training childcare education and more. Download Or Email AZ 5000 More Fillable Forms Register and Subscribe Now. Donate up to 400 single filer and up to 800 married filing jointly and Arizona will deduct 1 for 1 what you owe.

Free means free and IRS e-file is included. This tax code allows for donations to qualifying organizations be returned to the taxpayer not as a deduction but as a tax credit. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

We are a group of organizations who joined forces to promote the Arizona Charitable Tax Credit. Visit The Official Edward Jones Site. Arizona Small Business Income Tax Highlights Credit for Contributions to Qualifying Charitable Organizations A nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization QCO.

Make your tax credit donations from one easy-to-use site. Your tax credit may be. Special rules apply to individuals who are Married Filing Separate.

YOU CAN DONATE TO ANY QUALIFIED CHARITABLE ORGANIZATION OR PRIVATE SCHOOL IN THE STATE. Any credits for charitable contributions to Qualifying Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs not claimed in a tax year carry forward up to five years. Credit for cash contributions made to certain charities.

100 OF YOUR DONATIONS WILL PASS THROUGH TO THE ORGANIZATIONS YOU CHOOSE TO SUPPORT. The Credit for Donations made to Qualifying Charitable Organizations QCO provides vital support to Arizonas most vulnerable children and families. Our efforts have resulted in increased awareness and donations to nonprofits across Southern Arizona.

800 for married taxpayers filing a joint return.

Qualified Charitable Organizations Az Tax Credit Funds

Cdt Kids Charity Arizona Tax Credit

Arizona Tax Credits Mesa United Way

List Of 6 Arizona Tax Credits Christian Family Care

Start The Process Az Tax Credit Funds

Titlemax Products By State Titlemax Money Saving Tips Personal Loans Financial Tips

What You Need To Know About Arizona 2021 Tax Credits

![]()

Qualified Charitable Organizations Az Tax Credit Funds

Cdt Kids Charity Arizona Tax Credit

2021 Arizona Tax Credits Hbl Cpas

Qualified Charitable Organizations Az Tax Credit Funds

Start The Process Az Tax Credit Funds

Arizona Charitable Tax Credit Can Benefit Hcc

Donate To Arizona Tax Credit To Help Children Receive

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Qualified Charitable Organizations Az Tax Credit Funds

Expense Categories Ultimate Cheat Sheet